For the vast majority of property owners, signing up to a mortgage is a lifelong commitment that doesn’t end until retirement and even beyond that. A significant reason for this of this is the interest that is payable on the six figure sums required to buy most homes. So how do you save yourself thousands of pounds in interest on your mortgage and even pay it off early?

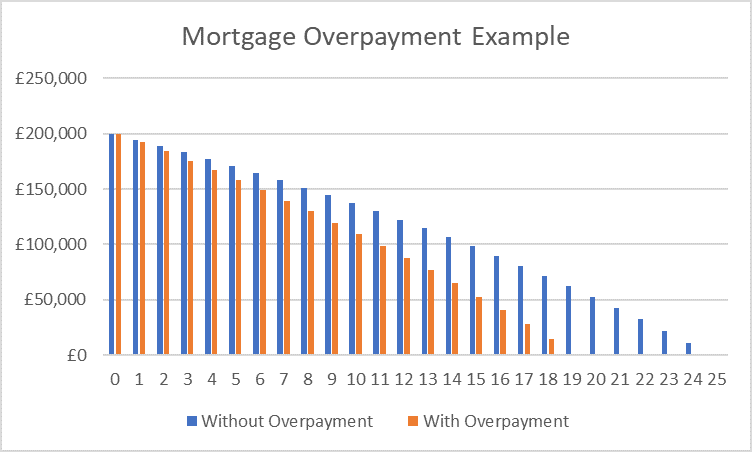

One of the best ways to save yourself thousands in interest over the term of the mortgage is to overpay. A study by comparethemarket has revealed that homeowners on a fixed rate mortgage can save an average £5,895 over the life of a mortgage with the added bonus of reducing the term by 3 years simply by overpaying £100 a month. First time buyers meanwhile could find themselves saving an average £6,129 in interest and see their term reduced by just over two years. The biggest winners from those overpaying their mortgage are those on SVRs who save an average £13,000 in interest overpaying by the same amount if they are on a higher interest rate. Example assumes a repayment mortgage of 200,000 at 3% interest. The chart is for illustration purposes only and should not be used as an accurate guide.

If you already have a mortgage, you may find that re-mortgaging your property could get you onto a better deal. A good mortgage broker can help you find the best re-mortgage products available at the lowest interest rates available. Fixing your mortgage at a lower rate of interest can save thousands over the term of the mortgage and it will also help you free up cash to overpay and reduce the debt further.

Having your mortgage interest rate set at the bank’s standard variable rate is hardly ever a good idea unless mortgage rates are on a prolonged downward curve. Even small percentage increases in mortgage rates can add significantly to monthly repayments and the interest you pay over the term of the mortgage. So for better financial security it is worth fixing your mortgage when interest rates are low (as they are now) to avoid a hike in your mortgage repayments if SVR rates rise. If you follow the above points you can save yourself a lot of money that might be better spent on retiring early or mortgage freedom at a much younger age. If you need advice on re-mortgaging or how to get the best deal on your mortgage contact us today.

Speak to us now on 01244 955 399 or request a callback from our team.